Why Blackstone

World’s Largest Alternative Asset Manager1

Blackstone is the world’s largest alternative asset manager with investment businesses spanning private equity, real estate, credit and hedge fund solutions. We remain committed to delivering strong performance across market cycles on behalf of institutions and eligible individual investors.

There can be no assurance that BXPE or any Blackstone fund or investment will achieve its objectives or avoid substantial losses.

Our Thematic Approach

Global Head of Blackstone Private Equity, Joe Baratta, discusses in our One-on-One series how the firm has positioned its investments to navigate today’s challenging environment.

Why Blackstone Private Equity

We do more than provide capital. We focus on building strong businesses to help deliver value to our investors.

A Blackstone investment in any portfolio company is no guarantee of future commercial opportunities or any value creation for such company.

Track Record

Proven track record investing in private equity across market cycles

35+ years

experience investing in private equity2

The above examples may not be representative of all investments of a given type or of investments generally and it should not be assumed that Blackstone will make comparable or equally successful investments in the future.

Expertise

Large global team with extensive industry knowledge

20 years

average tenure of BXPE investment committee professionals

Information Advantage

Our global presence and vast portfolio of companies generate proprietary data signals that help spot trends early6

28

global offices

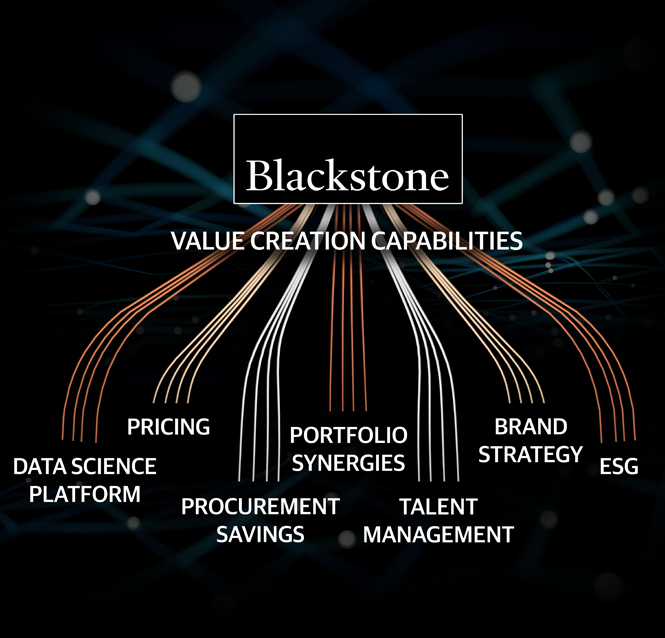

Value Creation Capabilities

Extensive business transformation capabilities and resources to help build better companies

~$100M

bottom line impact as a result of Blackstone data science initiatives7

A Blackstone investment in any portfolio company is no guarantee of future commercial opportunities or any value creation for such company.

There can be no assurance that any Blackstone fund or investment or strategy will achieve its objectives or avoid significant losses. There can be no assurance that Blackstone will be able to source or execute transactions relating to the above themes and opportunities. Nothing herein is intended as a prediction of how any financial markets, fund, or underlying manager will perform in the future and there can be no assurance that views and opinions expressed herein will come to pass. These ESG initiatives may not apply to some or all of BXPE’s investments and none are binding aspects of the management of the fund or its assets. There can be no assurance that these ESG initiatives will continue or be successful.

Why BXPE

LEARN MOREWhy BXPE

Portfolio

LEARN MOREPortfolio

Blackstone proprietary data as of February 28, 2025, unless otherwise indicated. Represents Blackstone’s view of the current market environment as of the date appearing herein. The figures herein include preliminary, unaudited results, which are subject to further review and adjustment. When used in this presentation and unless otherwise specified or unless the context otherwise requires, references to the “Fund” should be read as references to Blackstone Private Equity Strategies Fund SICAV (“BXPE”), Blackstone Private Equity Strategies Fund (Master) FCP, BXPE Aggregator and their parallel entities. Capitalized terms used but not defined will have the meanings set forth in the prospectus prepared for BXPE (the “Prospectus”). An investment in BXPE involves subscribing to shares of a collective investment and not of a given underlying asset.

While Blackstone believes ESG factors can enhance long-term value, BXPE does not pursue an ESG-based business strategy or limit its acquisitions to those that meet specific ESG criteria. Such considerations do not qualify Blackstone’s objectives to seek to maximize risk adjusted returns. BXPE does not promote environmental or social characteristics, nor does it have sustainable acquisitions as its objective.

Summary of Risk Factors

We have classified this product as 4 out of 7, which is a medium risk class. This rates the potential losses from future performance at a medium-high level, and poor market conditions could impact our capacity to pay you. There is no specific recommended holding period for the product. The actual risk can vary significantly, and you may get back less. You may not be able to sell your product easily or you may have to sell at a price that significantly impacts how much you get back. The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of movements in the markets or because we are not able to pay you. Complete information on the risks of investing in BXPE are set out in the prospectus.

BXPE is an investment program designed to offer eligible individual investors access to Blackstone’s private equity platform (the “PE Platform”). BXPE will seek to meet its investment objectives by investing primarily in privately negotiated, equity-oriented investments leveraging the talent and investment capabilities of Blackstone’s PE Platform to create an attractive portfolio of alternative investments diversified across geographies and sectors. Investing in our Shares involves a high degree of risk. If we are unable to effectively manage the impact of these risks, we may not meet our investment objectives and, therefore, you should purchase our Shares only if you can afford a complete loss of your investment. You should carefully review the prospectus for a description of the risks associated with an investment in BXPE. These risks include, but are not limited to, the following:

- Although the investment professionals of Blackstone have extensive investment experience generally, including extensive experience operating and investing for the PE Platform, BXPE has not commenced operations and has no operating history. We cannot provide assurance that Blackstone will be able to successfully implement BXPE’s investment strategy, or that investments made by BXPE will generate expected returns.

- This is a “blind pool” offering and thus you will not have the opportunity to evaluate our future investments before we make them.

- We do not intend to list our Shares on any securities exchange, and we do not expect a secondary market in our Shares to develop. In addition, there are limits on the ownership and transferability of our Shares. As such, BXPE can be described as illiquid in nature. Further, the valuation of BXPE’s investments will be difficult, may be based on imperfect information and is subject to inherent uncertainties, and the resulting values may differ from values that would have been determined had a ready market existed for such investments, from values placed on such investments by other investors and from prices at which such investments may ultimately be sold.

- We have implemented a periodic redemption program, but there is no guarantee we will be able to make such redemptions and if we do only a limited number of Shares will be eligible for redemption and redemptions will be subject to available liquidity and other significant restrictions. This means that BXPE will be more illiquid than other investment products or portfolios.

- An investment in our Shares is not suitable for you if you need ready access to the money you invest.

- The purchase and redemption price for our Shares will be based on our net asset value (“NAV”) and are not based on any public trading market. While there will be independent valuations of our direct investments from time to time, the valuation of private equity investments is inherently subjective, and our NAV may not accurately reflect the actual price at which our investments could be liquidated on any given day.

- The acquisition of our investments may be financed in substantial part by borrowing, which increases our exposure to loss. The use of leverage involves a high degree of financial risk and will increase the exposure of the investments to adverse economic factors.

- The private equity industry generally, and BXPE’s investment activities in particular, are affected by general economic and market conditions, such as interest rates, availability and spreads of credit, credit defaults, inflation rates, economic uncertainty, changes in tax, currency control and other applicable laws and regulations, trade barriers, technological developments and national and international political, environmental and socioeconomic circumstances. Identifying, closing and realizing attractive private equity investments that fall within BXPE’s investment mandate is highly competitive and involves a high degree of uncertainty.

- BXPE’s investments may be concentrated at any time in a limited number of industries, geographies or investments, and, as a consequence, may be more substantially affected by the unfavorable performance of even a single investment as compared to a more diversified portfolio. In any event, diversification is not a guarantee of either a return or protection against loss in declining markets. There is no assurance that BXPE will perform well or even return capital; if certain investments perform unfavorably, for BXPE to achieve above-average returns, one or a few of its investments must perform very well. There is no assurance that this will be the case.

BXPE is authorized and supervised by the Luxembourg supervisory authority, the Commission de Surveillance du Secteur Financier (the “CSSF”). Such authorization does not, however, imply approval by any Luxembourg authority of the contents of the prospectus or of the portfolio of investments held by BXPE. Any representation to the contrary is unauthorized and unlawful.

The words “we”, “us” and “our” refer to BXPE, together with its consolidated subsidiaries, including Blackstone Private Equity Strategies Fund SICAV (“BXPE Feeder SICAV”, such term including, unless the context otherwise requires, its sub-funds, and together with its master fund, feeder funds, parallel funds and other related entities), unless the context requires otherwise. Financial information is approximate and as of February 28, 2025.

Conflicts of Interest. There may be occasions when BXPE’s investment manager, and its affiliates will encounter potential conflicts of interest in connection with BXPE’s activities including, without limitation, the allocation of investment opportunities, relationships with Blackstone’s and its affiliates’ investment banking and advisory clients, and the diverse interests of BXPE’s investor group. There can be no assurance that Blackstone will identify, mitigate, or resolve all conflicts of interest in a manner that is favorable to BXPE.

Exchange Currency Risk. BXPE is denominated in U.S. dollars (USD). Shareholders holding Shares with a reporting currency other than USD should acknowledge that they are exposed to fluctuations of the USD foreign exchange rate and/or hedging costs (as applicable), which may lead to variations on the amount to be distributed, and all subscription payments and distributions, as well as returns, will be calculated and reported in the reporting currency of the Class. This risk is not considered in the indicator shown above. Currency fluctuations and expenses related to hedging transactions may negatively impact the returns of BXPE as a whole. Each Class of Shares may differ in overall performance, and certain fees (including, but not limited to, the Management Fee, Performance Participation Allocation and AIFM and Administration Fee) will be calculated in the Reference Currency. BXPE will incur expenses in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations.

Highly Competitive Market for Investment Opportunities. The activity of identifying, completing and realizing attractive investments is highly competitive, and involves a high degree of uncertainty. There can be no assurance that BXPE will be able to locate, consummate and exit investments that satisfy its objectives or realize upon their values or that BXPE will be able to fully invest its available capital. There is no guarantee that investment opportunities will be allocated to BXPE and/or that the activities of Blackstone’s other funds will not adversely affect the interests of BXPE.

Lack of Liquidity. There is no current public trading market for the shares, and Blackstone does not expect that such a market will ever develop. Therefore, repurchase of shares by BXPE will likely be the only way for you to dispose of your shares. BXPE expects to offer to repurchase shares at a price equal to the applicable net asset value as of the repurchase date and not based on the price at which you initially purchased your shares. Shares redeemed within two years of the date of issuance will be redeemed at 95% of the applicable net asset value as of the redemption date, unless such deduction is waived by BXPE in its discretion, including without limitation in case of redemptions resulting from death, qualifying disability or divorce. As a result, you may receive less than the price you paid for your shares when you sell them to BXPE pursuant to BXPE’s share repurchase program.

The vast majority of BXPE’s assets are expected to consist of private equity investments and other investments that cannot generally be readily liquidated without impacting BXPE’s ability to realize full value upon their disposition. Therefore, BXPE may not always have a sufficient amount of cash to immediately satisfy redemption requests. As a result, your ability to have your shares redeemed by BXPE may be limited and at times you may not be able to liquidate your investment.

No Assurance of Investment Return. Prospective investors should be aware that an investment in BXPE is speculative and involves a high degree of risk. There can be no assurance that BXPE will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met (or that the returns will be commensurate with the risks of investing in the type of transactions described herein). The portfolio companies in which BXPE may invest (directly or indirectly) are speculative investments and will be subject to significant business and financial risks. BXPE’s performance may be volatile. An investment should only be considered by eligible investors who can afford to lose all or a substantial amount of their investment. BXPE’s fees and expenses may offset or exceed its profits.

Recent Market Events Risk. Local, regional, or global events such as war (e.g., Russia/Ukraine), acts of terrorism, public health issues like pandemics or epidemics (e.g., COVID-19), recession, or other economic, political and global macro factors and events could lead to a substantial economic downturn or recession in the U.S. and global economies and have a significant impact on the Fund and its investments. The recovery from such downturns is uncertain and may last for an extended period of time or result in significant volatility, and many of the risks discussed herein associated with an investment in the Fund may be increased.

Reliance on Key Management Personnel. The success of BXPE will depend, in large part, upon the skill and expertise of certain Blackstone professionals. In the event of the death, disability or departure of any key Blackstone professionals, the business and the performance of BXPE may be therefore adversely affected. Some Blackstone professionals may have other responsibilities, including senior management responsibilities, throughout Blackstone and, therefore, conflicts are expected to arise in the allocation of such personnel’s time (including as a result of such personnel deriving financial benefit from these other activities, including fees and performance-based compensation).

Risk of Capital Loss and No Assurance of Investment Return. BXPE offers no capital protection guarantee. This investment involves a significant risk of capital loss and should only be made if an investor can afford the loss of its entire investment. There are no guarantees or assurances regarding the achievement of investment objectives or performance. This product does not include any protection from future market performance so you could lose some or all of your investment. If we are not able to pay you what is owed, you could lose some or all of your investment. BXPE’s performance may be volatile. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment. BXPE’s fees and expenses may offset or exceed its profits. In considering any investment performance information contained in this website, the prospectus and related materials (“the Materials”), recipients should bear in mind that past performance is not necessarily indicative of future results.

Risks of Secondary Investing. The funds managed by Strategic Partners (the “SP Funds”) expect to invest primarily in third party – sponsored private investment funds (“Underlying Funds”) and, indirectly, in investments selected by such unrelated sponsors. The interests in which the SP Funds seek to invest are highly illiquid and typically subject to significant restrictions on transfer, including a requirement for approval of the transfer by the general partner or the investment manager of the Underlying Funds. The SP Funds will not have an active role in the management of the Underlying Funds or their portfolio investments. The overall performance of the SP Funds will depend in large part on the acquisition price paid by the SP Funds for secondary investments and on the structure of the acquisitions. The performance of the SP Funds will be adversely affected in the event the valuations assumed by Strategic Partners in the course of negotiating acquisitions of investments prove to be too high. The activity of identifying and completing attractive secondary investments is highly competitive and involves a high degree of uncertainty. There can be no assurance that the SP Funds will be able to identify and complete investments which satisfy their rate of return objectives, or that they will be able to invest fully their committed capital. In many cases, the SP Funds expect to have the opportunity to acquire portfolios of Underlying Funds from sellers on an ‘all or nothing’ basis. It may be more difficult for Strategic Partners to successfully value and close on investments being sold on such basis. In addition, the SP Funds may invest with third parties through joint ventures, structured transactions and similar arrangements. These arrangements may expose the SP Funds to risks associated with counterparties in addition to the risks associated with the Underlying Funds and their managers and portfolio companies.

Sustainability Risks. BXPE may be exposed to an environmental, social or governance event or condition that, if it occurs, could have a material adverse effect, actual or potential, on the value of the investments made by BXPE. Blackstone seeks to identify material sustainability risks as part of its investment process.

Target Allocations. There can be no assurance that a Fund will achieve its objectives or avoid substantial losses. Allocation strategies and targets depend on a variety of factors, including prevailing market conditions and investment availability. There is no guarantee that such strategies and targets will be achieved and any particular investment may not meet the target criteria.

- Largest global alternative asset manager reflects Preqin data as of March 31, 2024.

- The investments shown above were made by existing Blackstone funds, are not held by BXPE, are intended to be illustrative of investment themes identified herein, and were selected based on audience familiarity of widely known brands.

- Private Equity International, as of June 2024, based on capital raised between January 1, 2019 and December 31, 2023.

- Source: Blackstone analysis of Preqin data, as of March 31, 2024. Based on Blackstone’s analysis of buyout, growth, opportunistic, and secondaries strategies, Blackstone has the most number of funds launched among US-based alternative investment managers. Includes funds that are in various stages of capital raising, including liquidation. This selection of alternative investment firms for comparison may not be representative of all in the category or sector.

- AUM is estimated and unaudited as of March 31, 2025 and sourced by Blackstone. Private equity AUM represents AUM across Blackstone private equity, spanning across Corporate Private Equity, Tactical Opportunities, Growth, Strategic Partners, Life Sciences, and Infrastructure. AUM includes co-investments and Blackstone’s GP and side by side commitments, as applicable.

- Subject to Blackstone’s policies and procedures regarding information walls and the management of conflicts of interest.

- “Bottom line impact” refers to EBIDTA impact, which is determined by: (i) identifying operational key performance indicators (KPIs) that may benefit from AI, (ii) measuring those KPIs both before and after the implementation of the AI model, and (iii) translating the impact on relevant KPIs to EBITDA. Methodologies for calculating EBIDTA impact vary based on the facts and circumstances associated with participating portfolio companies and are subject to limitations including the amount, nature and quality of available data. While the implementation of AI correlates with an increase in EBITDA among the portfolio companies included, there can be no assurance that such EBITDA increase was not caused by other factors in addition to or in spite of implementation of AI programs.